The following was originally posted on our Cleary Securities, Disclosure, and Governance Watch blog.

I. Introduction

In November 2025, the Division of Corporate Finance (the “Staff”) of the Securities and Exchange Commission (the “SEC”) announced that it would no longer provide substantive responses to most no-action requests for shareholder proposals during this proxy season. Since this announcement (the “Announcement”), public companies have found themselves in uncharted territory. While companies may request a response from the Staff if they provide an unqualified representation that the company has a reasonable basis to exclude the proposal under Rule 14a-8, the Staff will only issue a no-action response based on that unqualified representation, and not based on any independent analysis of the merits of the arguments presented. Without the added assurance of the SEC’s substantive review, a number of companies have refreshed their strategic approach to no-action letters this proxy season. The exclusion notices[1] that have been submitted since the Announcement provide a glimpse into emerging trends regarding how companies and their legal counsel are interpreting the announcement and navigating this unguided landscape.

II. Trends and Insights

A. Scope of Letters

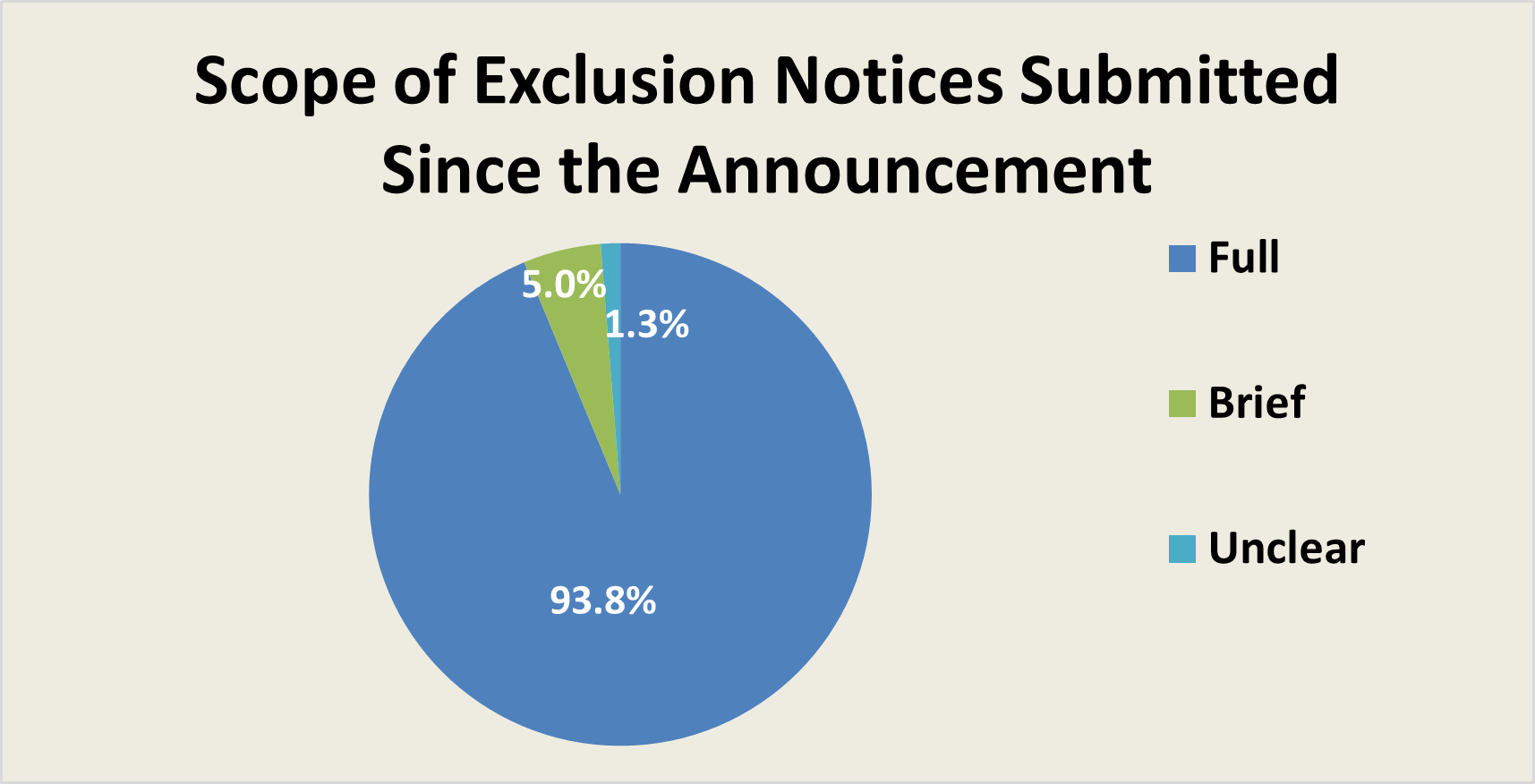

The shift from a substantive argument that would be evaluated on its merits by the Staff to a notice of exclusion raised the possibility that the letters could become more succinct, giving rise to concern that there would be more limited detail provided on why a company excluded a particular shareholder proposal. The Staff noted in the Announcement that “a company’s Rule 14a-8(j) notification should be limited to the information required by the rule” and, in a subsequent public discussion, confirmed that a simple notice of exclusion limited to the proposal and the company’s reason for exclusion was sufficient. However, out of the 80 exclusion notices submitted by companies under this new process with a response from the Staff made publicly available on the SEC’s website through January 26, 2026, 75 (94%) were of similar scope and format to those submitted before the Announcement, substantively arguing the merits of an exclusion. Only four notices were limited in scope, stating briefly only the basis for exclusion and the rule upon which they relied, without further analysis. The trend of companies including detailed explanations, despite the SEC indicating that the contrary is acceptable, may be an attempt to satisfy investor and other stakeholder concerns (as illustrated by ISS guidance discussed below in “Key Items for Further Consideration”), provide a better understanding of the companies’ rationale from a governance perspective, and mitigate some of the potential risk of complaints or legal challenges by proponents of the proposals.

B. Basis for Exclusion

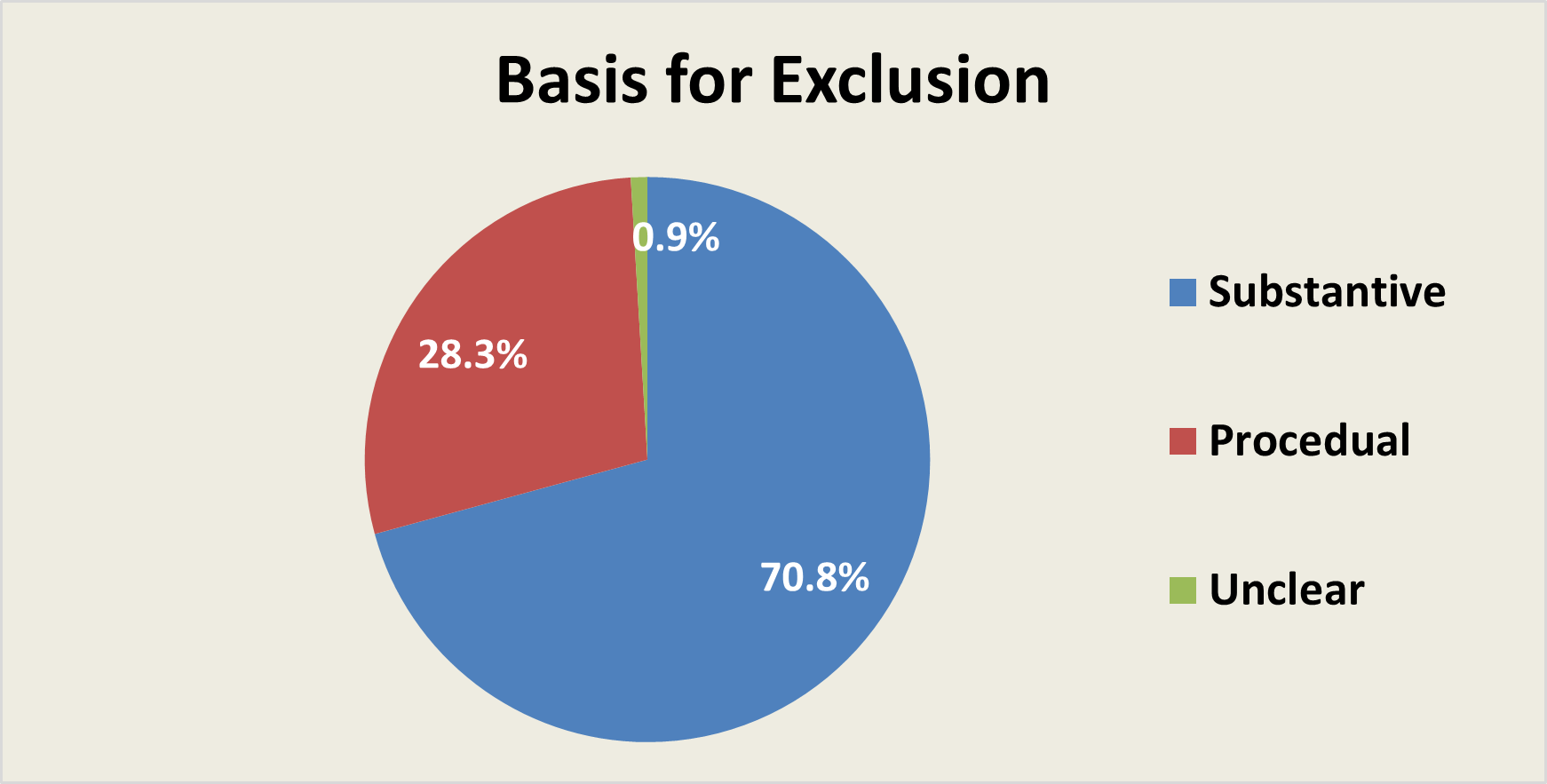

Because the Staff declined to comment on the substance of no-action requests, procedural grounds were expected to gain more footing. However, this has not been the case. Among the 103 bases used in the exclusion notices we reviewed on or after the Announcement and made publicly available on the SEC’s website through January 26, 2026, 75 (71%) were substantive arguments. Well under a majority of the bases used post-Announcement were based on procedural grounds, demonstrating that companies have continued to use substantive grounds even after the SEC stopped commenting on their merits.

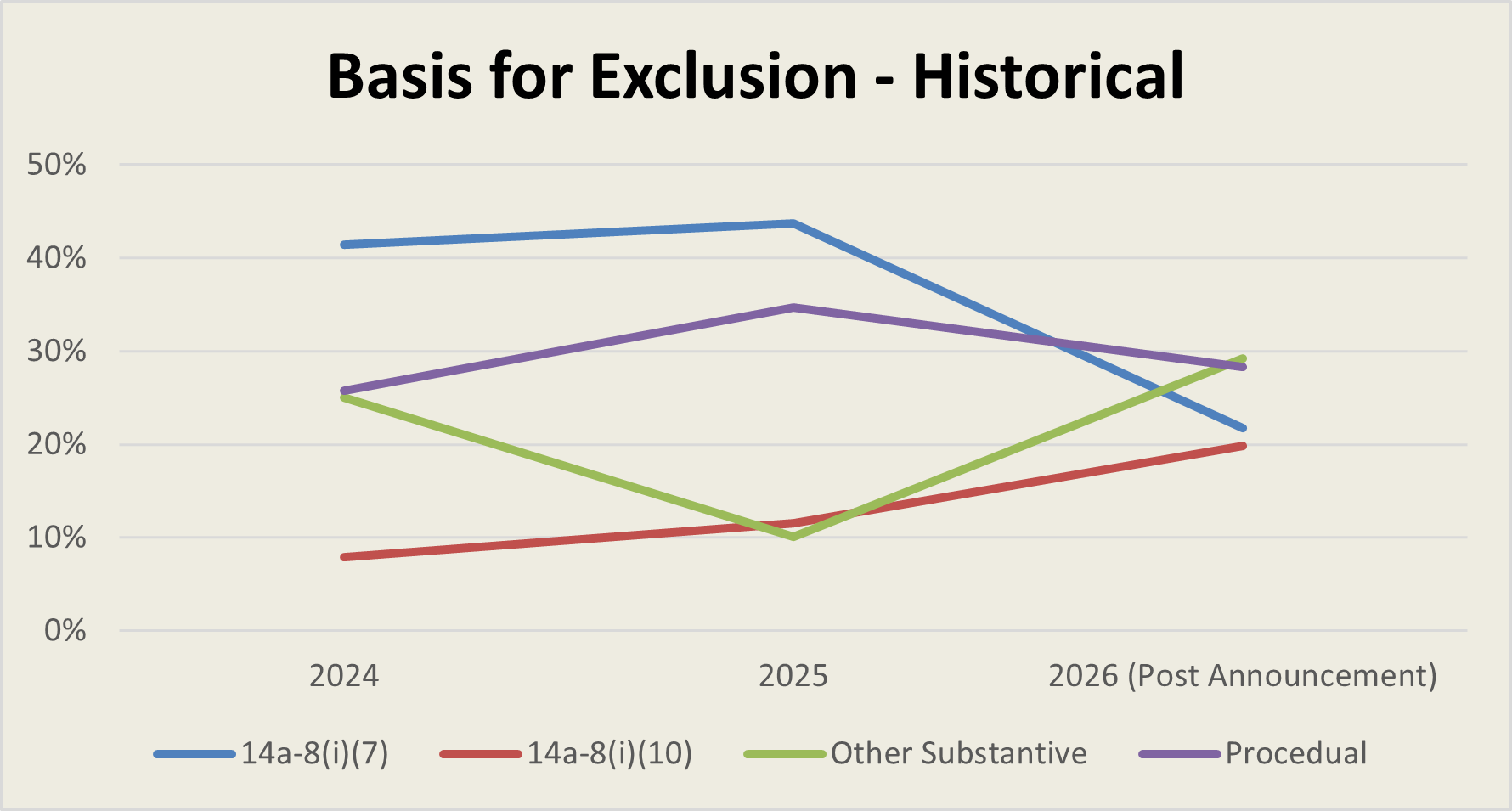

If we look deeper into individual bases of exclusion actually relied upon to exclude a proposal, there is some change in those used. It is important to note, however, that the historical data reflects Staff-supported exclusions under the pre-Announcement process while the current data, post-Announcement, reflects company self-determinations supported by reasonable basis representations. In the past two proxy seasons, the ordinary business basis of Rule 14a-8(i)(7) was by far the most used when actually excluding a proposal, accounting for over 40% of all bases under which exclusion was granted by the Staff. While it remains the most common basis of exclusion post-Announcement, its share has dropped to approximately 22% of the exclusion rationales publicly available on the SEC’s website through January 26, 2026. A close second is the substantial implementation basis of Rule 14a-8(i)(10). This basis represented only 7.8% and 11.6% of total bases under which exclusion was granted by the Staff in the past two proxy seasons, respectively, but has jumped to nearly 20% post-Announcement, representing a notable increase in its use.

One basis under which the Staff is continuing their substantive review is Rule 14a-8(i)(1), which allows exclusion of proposals that are improper under state law. In the Announcement, the Staff explained that this exception is due to recent developments and a lack of guidance regarding the application of state law and Rule 14a-8(i)(1) to precatory proposals, which are drafted as recommendations to the board and do not require the board to take action even if approved by shareholders. This followed SEC Chair Paul Atkins’s recent speech in which he hinted that Delaware law may not confer on shareholders an inherent right to vote on precatory proposals. Despite this exception, we have not identified any exclusion notices submitted on this basis since the Announcement.

III. Key Items for Further Consideration

Beyond just the exclusion of proposals via the submission of Rule 14a-8(j) notices, companies should also consider the following items as the proxy season progresses:

- Companies should consider whether to address the exclusion of shareholder proposals in their proxy statements. Out of five companies that filed a proxy statement after filing an exclusion notice this season through January 26, 2026, only two have included references to the excluded proposals in their filings. Institutional Shareholder Services (“ISS”) recently stated in its guidance that “Companies choosing to exclude a proposal on ‘ordinary business’ grounds should clearly explain why they believe that to be the case, and when there is precedent from the SEC or a court that appears relevant to the proposal in question, why they believe such a precedent does or does not apply.” ISS further expanded on this guidance in a recent webcast, during which an ISS representative explained that if companies feel their notice of exclusion “sufficiently explained why the company… decided to exclude the proposal,” it could potentially stand on its own. However, if the exclusion notice is brief, further explanation in the proxy statement would be needed.

- Separate from any statements made in connection with ISS’s guidance, companies may also be considering whether to identify excluded proposals in the proxy statement pursuant to Rule 14a-4(c)(2) and note that the board would exercise discretionary voting authority against them if they were brought as floor proposals. Historically, companies have not included this type of disclosure in their proxy statements. Similarly, we have not seen such language in the few proxy statements already filed by companies that submitted an exclusion notice under the new guidance, but we are still early in the proxy season.

[1] Given the change in approach and the purpose of the letters, we refer to letters submitted after the Announcement that include an unqualified representation as “exclusion notices.” Our exclusion notice data does not include post-Announcement letters lacking an unqualified representation, which are being separately processed and posted by the SEC as “Rule 14a-8(j) Notifications With No Division Response Forthcoming”.