For more insights and analysis from Cleary lawyers on policy and regulatory developments from a legal perspective, visit What to Expect From a Second Trump Administration.

As the U.S. government shutdown stretches into its sixth week—and in light of the SEC’s clarification that it will not be reviewing and declaring registration statements effective via the traditional route during the shutdown—issuers seeking to proceed with primary and secondary offerings are turning to a statutory alternative that permits registration statements to go automatically effective without SEC clearance.[1] The exchanges have indicated willingness to play along, with some regulatory caveats,[2] and SEC leadership has publicly endorsed this method of having a registration statement go effective during the shutdown.[3]

To assess how issuers are navigating the shutdown in light of this guidance, we reviewed registration statements on Forms S-1 and F-1 that removed the typical delaying effectiveness legend and affirmatively included the Rule 473(b) automatic-effectiveness legend and were filed between October 1 to November 6. This cohort represents issuers willing to move forward without formal SEC clearance, offering a practical glimpse into how the market is utilizing the auto-effectiveness pathway.

While the vast majority of S-1 and F-1 filings observed during this period continue to retain the standard delaying legend, our dataset identified 132 S-1 or F-1 registration statements including the exact wording of the automatic-effectiveness legend set forth under Rule 473(b) required for proceeding with this approach. Out of the total dataset, 71 were S-1/As and 33 were new S-1s, with 25 F-1/As and 3 new F-1s representing the remainder. The majority were amendments—approximately 73%. This finding suggests that many issuers originally on file with delaying legends prior to the shutdown elected to pivot to the automatic-effectiveness approach following the lapse in government funding (potentially having already addressed initial SEC staff comments).

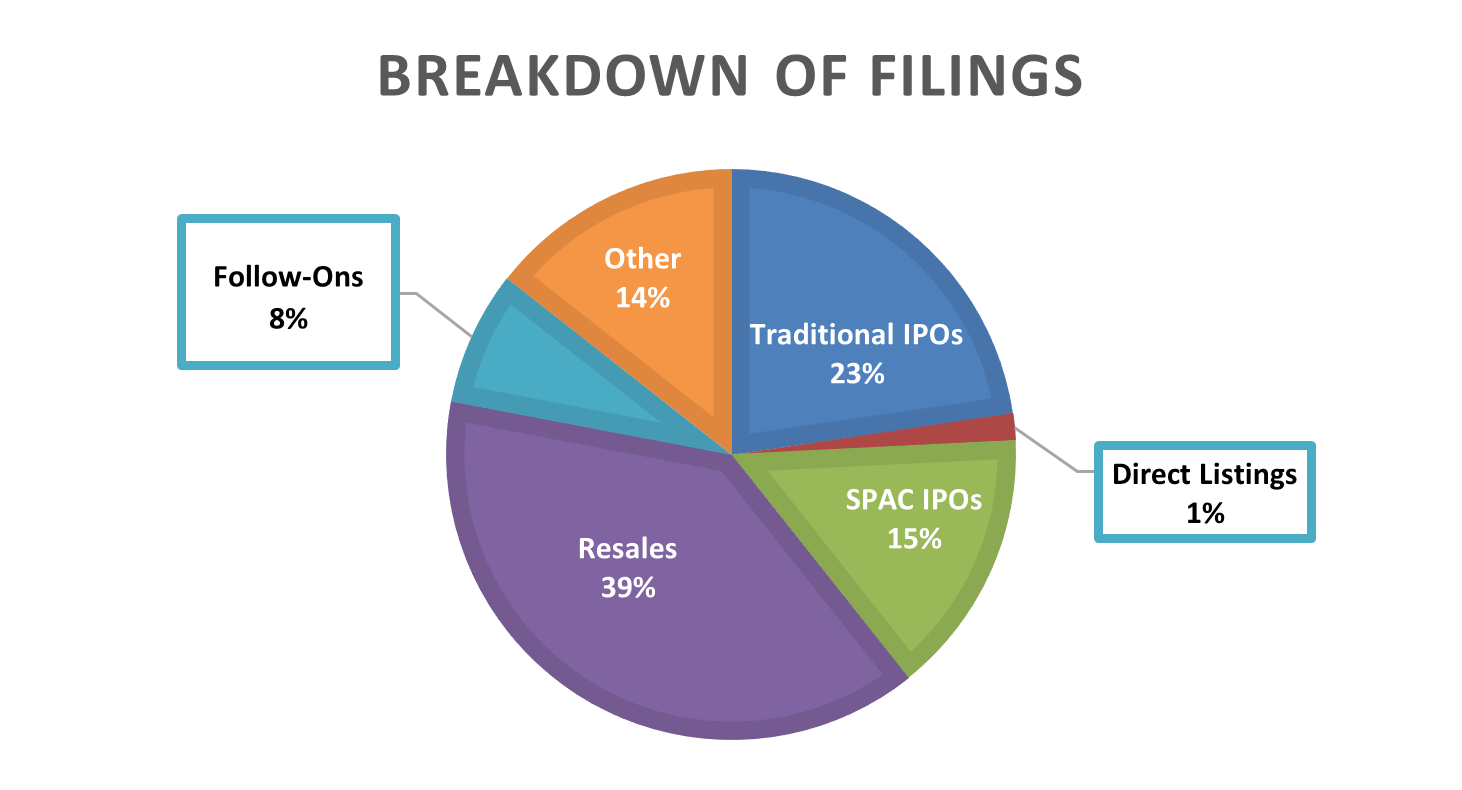

Across this data set:

- Resale registration statements (51) and registered follow-ons (10) comprised roughly 47% of the total, filed mostly by smaller public issuers likely seeking to satisfy resale registration rights from recent private placements or similar transactions. Resale registration statements and follow-on offerings represent more common use cases for registration statement auto-effectiveness as the shutdown drags on, as follow-on offering and resale related registration statements filed by already public companies generally have a lower likelihood of being selected for review and have relatively lower risk of being flagged by the SEC once the government reopens.

- Traditional IPOs (30) and direct listings (2) represented about 24% of the total, while SPAC IPOs (20) represented approximately 15%. Ultimately, the IPOs and direct listings proceeding during the shutdown tend to be those which had made significant progress in the SEC review process before funding lapsed. With a few exceptions, the companies moving forward with traditional IPOs and SPAC IPOs overwhelmingly tended toward modest-sized offerings by those anticipated to trade as micro-cap companies, many in niche markets, and included several controlled companies.

- The remainder included a small subset of filings for equity lines and other atypical transactions (19, or roughly 14%).

As we are well over 20 days into the shutdown, a number of these registration statements have now automatically gone effective, with several SPAC and traditional IPOs having actually closed and begun trading.

The number of companies relying on auto-effectiveness during this shutdown is significant compared to the last extended government shutdown (December 22, 2018 – January 25, 2019). Over that 34-day period, only 23 registration statements could be identified as including the Rule 473(b) automatic-effectiveness legend. This represents roughly one-sixth of the filings observed during the current shutdown (October 1 to November 6, 2025), and to our knowledge, none of the filings from 2018-2019 actually went effective.

As the shutdown continues, more companies appear to be proceeding without formal review. However, this approach carries risks, as the SEC may issue additional comments (even after a registration statements goes effective after the 20-day period) and request that a company file another amendment to resolve those comments, which could impact the company’s ability to consummate the transaction. If necessary, the SEC may also issue a stop order or take other emergency actions, which could delay or hinder the transaction. Issuers observing all of this activity and considering the automatic-effectiveness approach for themselves, both under the current shutdown or any potential future shutdown, should carefully assess their disclosure readiness, potential liability, and investor relations concerns—and should consult with legal counsel to determine whether this path suits their capital needs and financial objectives.

[1] See Securities & Exchange Commission, Updated Division of Corporation Finance Actions in Advance of a Potential Government Shutdown (Oct. 9, 2025), https://www.sec.gov/newsroom/whats-new/updated-division-corporation-finance-actions-advance-potential-government-shutdown-october-09-2025

[2] See Nasdaq, Impact of Government Shutdown — Frequently Asked Questions (Oct. 1, 2025), Nasdaq Listing Center, https://listingcenter.nasdaq.com/assets/Impact_of_Government_Shutdown_Nasdaq_FAQ.pdf; see also from the latest extended government shutdown, New York Stock Exchange, FAQ: Listing During the Government Shutdown (Jan. 24, 2019), https://www.nyse.com/publicdocs/nyse/regulation/nyse/FAQ_-_Listing_During_the_Government_Shutdown.pdf.

[3] Atkins, Paul (@SECPaulSAtkins), Tweet (Oct. 9, 2025, 2:15 p.m.), https://x.com/SECPaulSAtkins/status/1983289354815713289